Cox Automotive’s Forecast: 2024 – A Return to Normalcy in the U.S. Auto Market

AutoSuccess

JANUARY 29, 2024

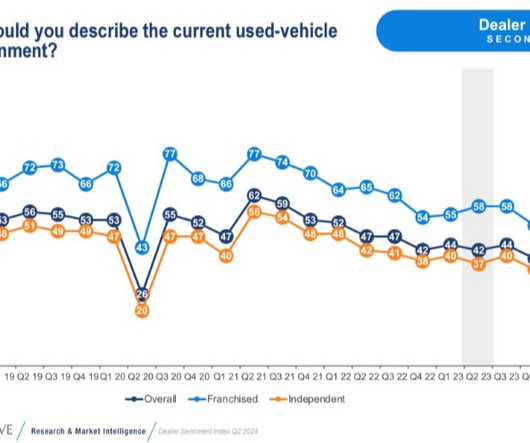

auto market, the word that will likely sum up 2024 is “normalcy,” according to Cox Automotive’s Forecast: 2024. Powered by the best data and keenest insights, Cox Automotive developed five themes that offer a collective vision and valuable perspective on the road ahead for the U.S. auto industry.

Let's personalize your content