Cox Automotive’s Forecast: 2024 – A Return to Normalcy in the U.S. Auto Market

AutoSuccess

JANUARY 29, 2024

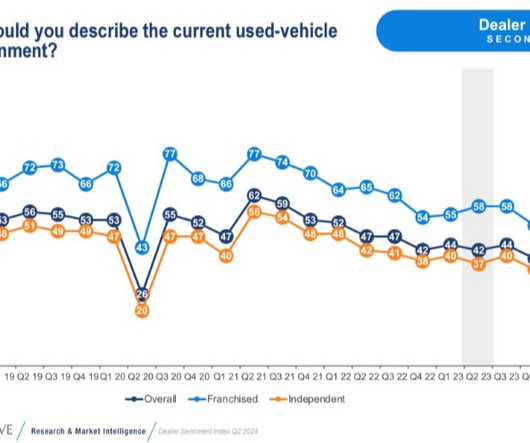

auto market, the word that will likely sum up 2024 is “normalcy,” according to Cox Automotive’s Forecast: 2024. auto industry. “To name a few, we saw historic appreciation in vehicle values, unimagined drops in supply, and interest rates moving from all-time lows to 23-year highs at an unforgiving pace.

Let's personalize your content