Uncovering Hidden Costs: How Car Finance Agreements Affect Consumers

Auto Service World

FEBRUARY 16, 2025

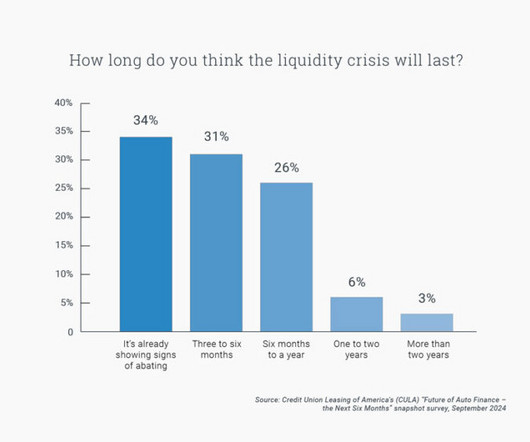

Car ownership has long been a symbol of independence and mobility, but the way people finance their vehicles has evolved significantly. With more consumers opting for car finance agreements to afford their dream cars, issues related to transparency and fair lending practices have become a growing concern.

Let's personalize your content