Prices plateau in more stable used-car environment

Auto Remarketing

APRIL 29, 2024

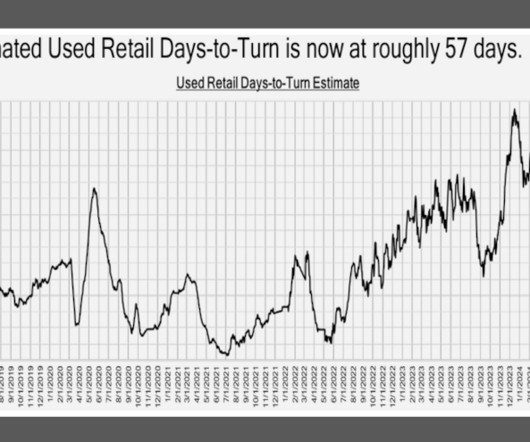

The CARFAX Used Car Index made its debut a year ago, and in an analysis recapping the latest installment , the company pinpointed three retail used-car pricing trends that have stood out. Tom Kontos, the chief economist at ADESA, has noticed a similar flattening in wholesale used-car prices.

Let's personalize your content